What are Security Tokens?

Security Token Offering (STO) is a regulated offering of securities using digital tokens based on blockchain technology. Security Token Offerings (STOs) combine the blockchain technology with the requirements of regulated securities markets to achieve various advantages over the traditional trade of securities. The blockchain could be based on an existing system such as Ethereum or be based on a specially created system to fulfil additional requirements. One of these requirements may include additional information in case of transfer and other controls to enable regulatory compliance. These tokens can be created, bought, registered in a wallet, transferred, sold and destroyed (“burned”).

In addition to the points mentioned above, STOs may be listed on an exchange as well. Therefore the key difference to other forms of securities is in the underlying technology, namely the blockchain technology. STOs are usually digital representations of other assets or instruments such as stocks, bonds, real estate, intellectual property, etc.

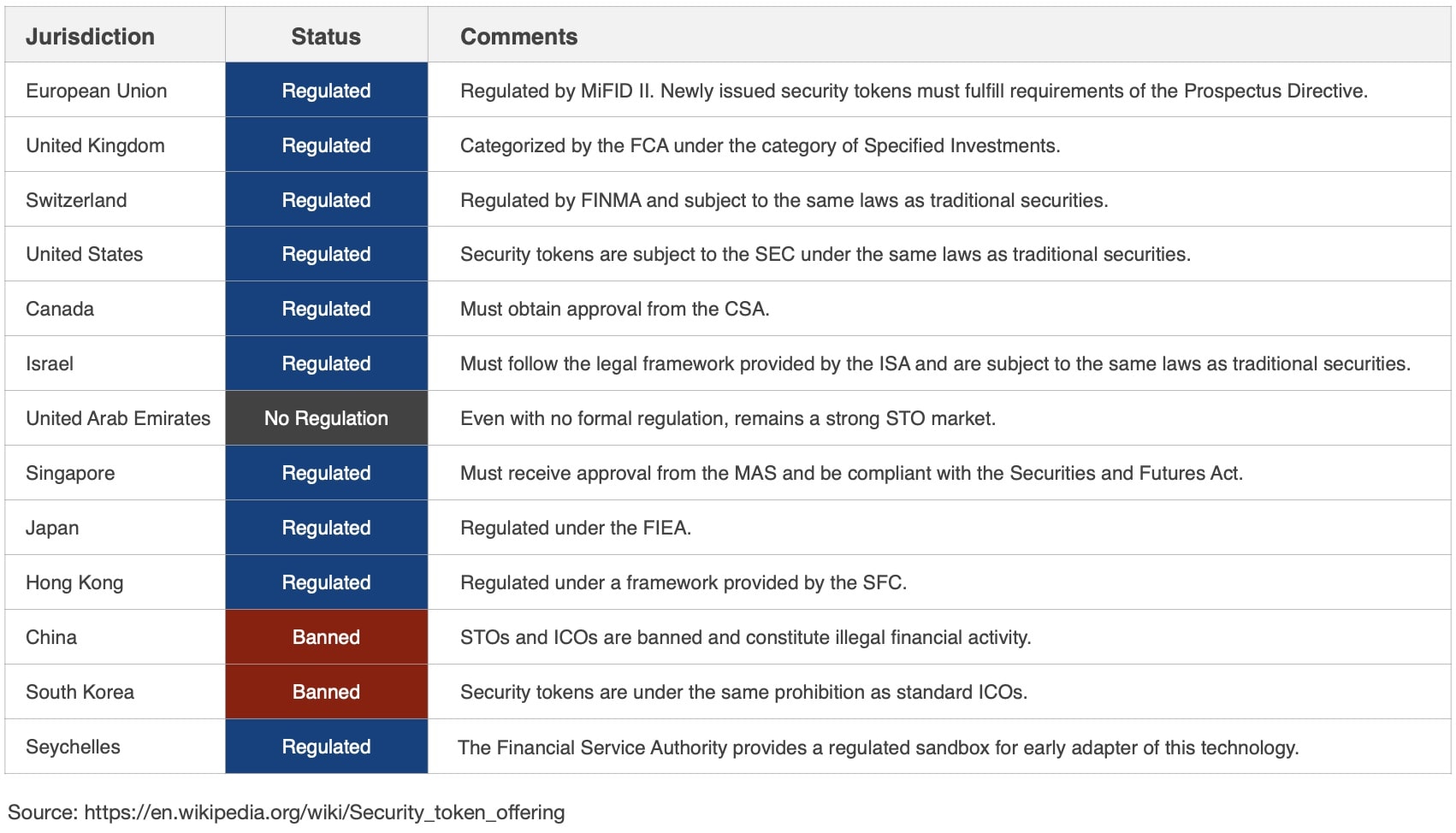

This is reflected in the fact, that a lot of countries regard the STOs as an equivalent to “normal” securities.

The Swiss regulator FINMA categorises tokens into three types, but hybrid forms are possible:

PAYMENT TOKENS

Payment tokens are synonymous with cryptocurrencies and have no further functions or links to other development projects. Tokens may in some cases only develop the necessary functionality and become accepted as a means of payment over a period of time. They usually have no underlying assets.

UTILITY TOKENS

Utility Tokens are tokens which are intended to provide digital access to an application or service.

ASSET TOKENS

Asset tokens represent assets such as participations in real physical underlyings, companies, or earnings streams, or an entitlement to dividends or interest payments. In terms of their economic function, the tokens are analogous to equities, bonds or derivatives.

How Can You Tokenise an Asset?

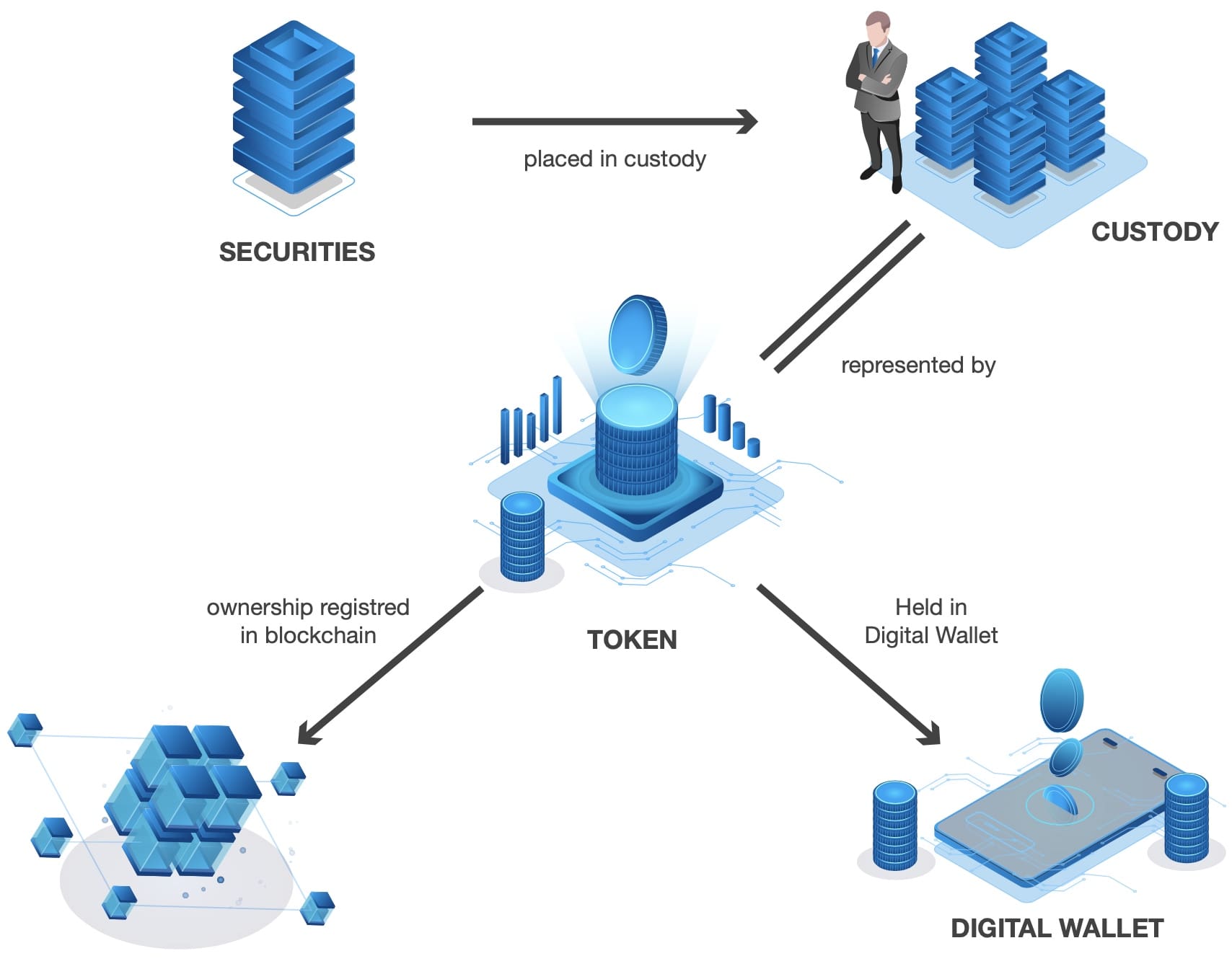

Security tokens are similar to analog securities but provide an easier and more secure way to trade it. By tokenizing assets such as company shares, real estate, pieces of art or intellectual property rights, the original owner of the assets can monetise such assets in whole or in part through an STO with much lower transaction costs and an immediate access to a wide audience.

The process starts with putting the asset into custody of the custodian in charge of the tokenisation. Tokens are then issued against the asset in custody, assigning to each token holder a defined share of the underlying asset.

Advantages of Tokenised Assets

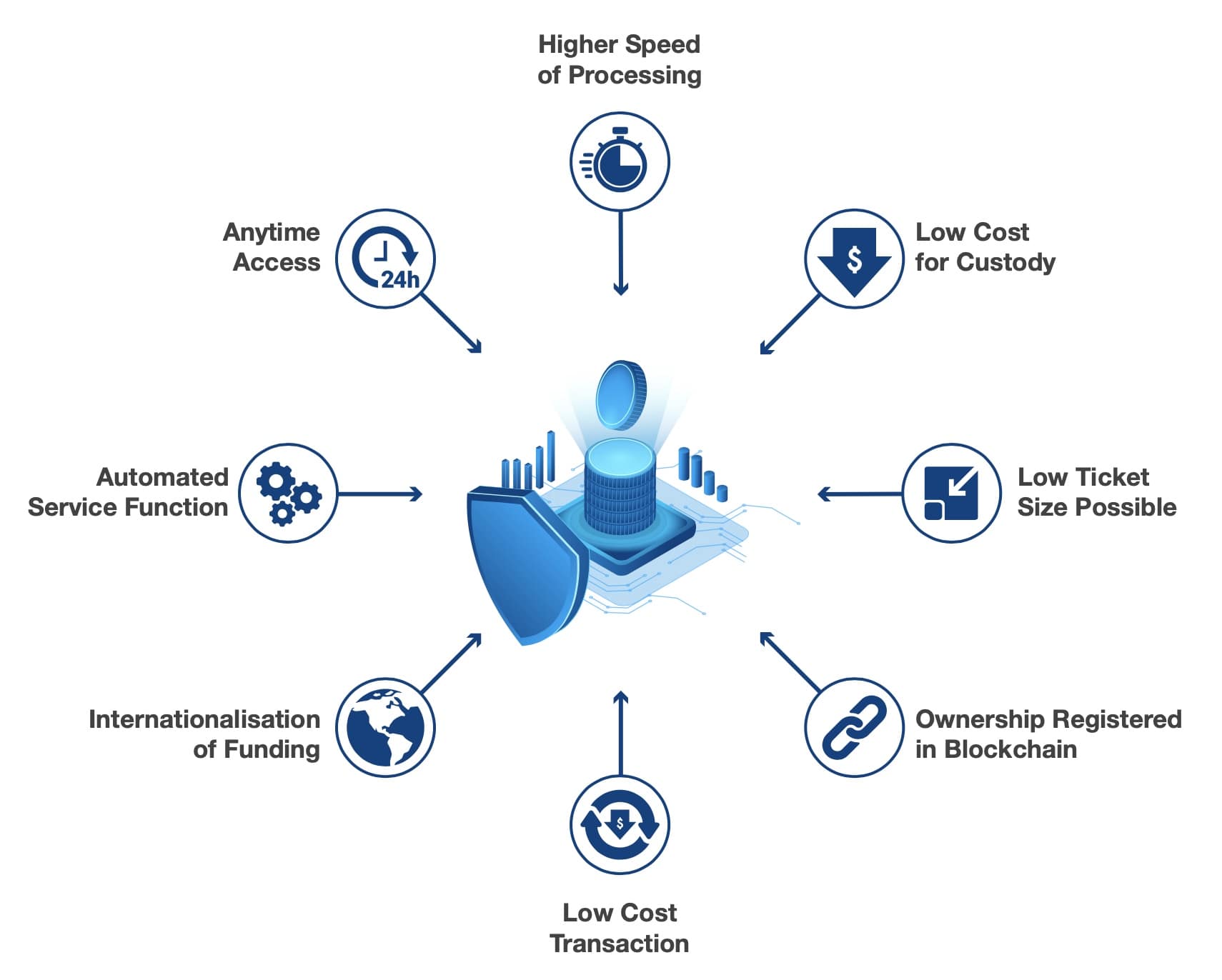

There are a lot of good reasons, why tokenisation should be considered to trade assets.

This is just a list of some of the advantages:

Low Cost Transaction

The transfer of tokens follows a defined process, that is mainly the entry in the blockchain. The cost for this transaction is very low and doesn’t involve costly lawyers or similar.

High Speed of Processing

The simplicity of the transfer is reflected in the speed of processing a request. Transactions are done fast and are still properly documented.

Automated Service Function

Transaction with tokens can be handled by smart contracts. Such contracts can lead to an automated fulfilment (for example transfer of a token), when defined conditions are met (for example money booked on an account). This provides a high security for the fulfilment of contracts.

Anytime Access

The automation of the process leads to a 24/7 access to the basic functions like buying and selling of tokens. This access may be limited in case of non-automated compliance checks.

Owner Registered in Blockchain

The ownership is defined in the blockchain, the new top standard when it comes to data security. The vast network of computers, that have to validate a transfer, make it impossible to cheat in the log entry.

Low Ticket Size Possible

The number of tokens issued against an asset in custody can be defined independently of for example the number of shares or the number of pieces of art represented by the tokens. This allows to chose a low ticket size for the tokens.

Internationalisation of Funding

Subject to legal limitation, tokenisation allows an immediate international access to investors. It becomes easier to approach investors from other countries and investors have no or less hurdles to invest in a token.

Low Cost for Custody

Banking services come with a steady increasing price tag. The costs for the administration of investment accounts are no difference to this fact. Holding tokens in a digital wallet is close to free of cost and dividend payments are done directly on the account of the holder of the tokens.

Challenges of Tokenisation

Security Tokens can be a better compliance solution than the traditional securities.

Although in most jurisdictions STOs are regulated like the usual securities, compliance is still a major concern. Contrary to common believe, Security Tokens can create an easy compliance solution by including compliance measures into the token itself.

This is an important point, therefore we say again: Security Tokens can be a better compliance solution than the traditional securities.

This needs some explanation, therefore let’s compare ERC-20, the most common token protocol used for an ICO, with that of tokens used for STOs.

ERC-20 is a protocol that defines the following mandatory functions:

- totalSupply() – shows the current total supply of tokens in circulation.

- balanceOf() – keeps track of the balance in each user wallet.

- transfer() – allows a user to to send a given amount of tokens to another address.

- transferFrom() – allows a smart contract to automate the transfer process in behalf of the user.

- approve() – guarantees that nobody could create more tokens out of nothing, keeping the supply under control.

- allowance() – makes sure that the user has enough balance and cancels a transaction if there are insufficient tokens.

It is obvious, that these functions don’t provide any ability to restrict transfers (for example to ban investors from certain jurisdictions) or to define a lock-up period, for example.

The ERC-20 protocol misses a lot to make it a compliant securities offering. Fortunately, there are alternatives available, one of them the Security Token protocol developed and used by SECDEX, a digital exchange registered in the Seychelles.

Security Tokens can be programmed to enable your for everything from administrator transfer functions to forced transfers, and a whole lot more:

- Code / Reference Link

- Get number of holders function

- Granularity

- Token sender hook

- Token receiver hook

- Data parameter in transfer functions

- Transfer administrator function

- Transfer administrator event

- Get metadata of an address

- Static and Dynamic checks

The list could be extended, but it already shows clearly, that tokens can be programmed to provide much more information as defined in the ERC-20 protocol. Having said that: Adding more information to a token increases the complexity, therefore each addition should be carefully considered.

A simple version of such a “reduce to the max” solution is presented with ERC-1404, named the “Simple Restricted Token Standard,” which adds two basic functions to the ERC-20 standard. These functions let you enforce some of the previously mentioned transfer restrictions, for instance relating to an investor’s jurisdiction.

Therefore it is important to state, that the challenge of compliance and regulation can be handled with Security Tokens. It is just a question about which protocol is used. Given the high level of automation, tokens can prove to be the better choice, when it comes to compliance.

STO Go from Strength to Strength

There is a growing number of experts predicting, that STOs will replace the IPOs in the near future. STOs are considered to be a good option for capital raising – even outside the tech-crowd. One of the main reasons for the move from IPOs to STOs is of course the cost factor: A normal IPO costs easily 2 to 4 million USD or more. An STO costs less than USD 100’000.

The huge costs for an IPO are the main reason, why not more companies turn to the capital market to get additional funding. The STOs lower this barrier and give more players a chance, to present their investment opportunities.

Obviously STOs should be done by a trustworthy partner, that properly establishes the credential of the underlying assets and documents this comprehensively in the investment catalogue. Trading places like SECDEX provide such a well regulated environment, where the players have to be transparent and where wrong claims are detected and punished.

About the Solution Provided by Hensley&Cook with SECDEX

Hensley&Cook is a well established corporate service provider with offices in the Seychelles, Philippines, Singapore and UAE. Hensley&Cook is a sponsor at the Securities, Commodities and Derivatives Exchange (SECDEX) in the Seychelles. SECDEX offers a trading platform for traditional and digital assets combining the benefits of a digital exchange with those of a traditional exchange.

The SECDEX ecosystem allows a cost efficient and fast tokenisation of traditional assets including a listing at the stock exchange. SECDEX even provides a digital marketplace to lend cryptocurrency against tokenised assets. Cap Lion Point, the investment bank of the CRESCO Group, offers e-wallet solutions to store the tokens in a cost efficient way.

Hensley&Cook being a sponsor at SECDEX allows it to use the respective tokenising technology and to facilitate listing of tokenised assets on the exchange.

These guidelines have been prepared by the Financial Services Authority (“the Authority”) to provide guidance on matters pertaining to the Regulatory Sandbox applicants under the Financial ServicesAuthority (Regulatory Sandbox Exemption) Regulations, 2019 (“the Regulations”). The regulatory sandbox (“sandbox”) allows firms to test innovative eligible financial services or products within a defined duration and controlled environment. It shall include adequate safeguards measures to ensure consumer protection in cases of failure and to ensure the overall safety and soundness of the financial system.

The sandbox allows for testing through exemptions from certain licensing, disclosure and reporting requirements under the Securities Act, 2007 on a case‐by‐case basis.